As I mentioned earlier, the period between the second half of March and April is typically marked by seasonal weakness, which is also supported by four bullish cases that align with the conditions in the KLCI. The recent escalation of tensions between Iran and Israel has created a substantial opportunity for investors to consider quality companies, especially if their share prices drop.

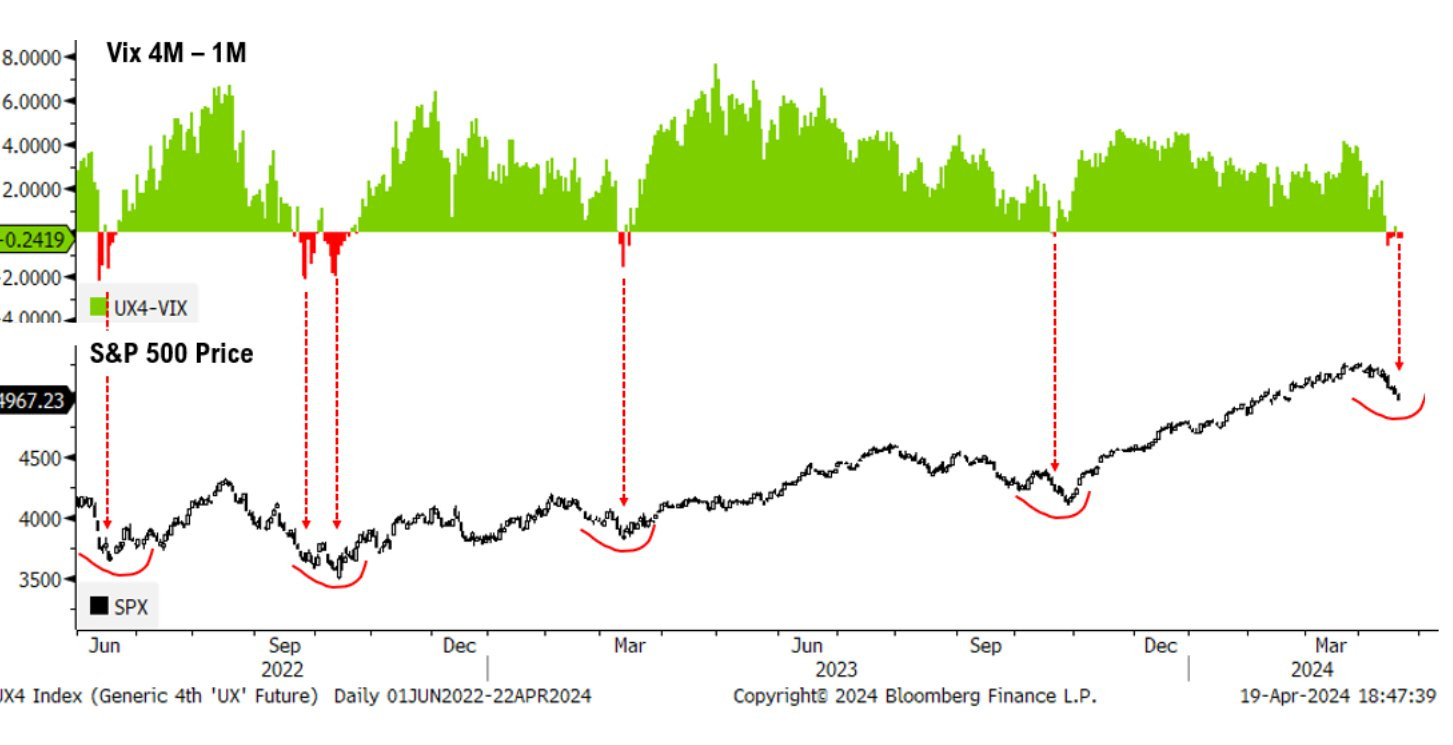

The conflict between Israel and Iran appears to be drawing to a close. Meanwhile, the VIX—a measure of market volatility—consistently remains below 18, suggesting stability. The VIX 4m-1m is in backwardation, indicating that the U.S. market S&P500 has experienced a pullback. So far, it has only reached 5.73%, which seems to have been completed. This scenario presents a significant opportunity to acquire more shares and benefit from the market trend. The S&P 500 is currently recovering from this dip. Markets appear to be adapting to the ongoing tensions and becoming accustomed to the situation. If upcoming corporate earnings are favorable and inflation is managed well, the positive market trend could continue.

Considering both the VIX and the KLCI index, there is a clear correlation between the two indicators. The higher the VIX index, the more pronounced the market pullbacks and corrections. Although the recent pullback has been minimal, it still presents excellent investment opportunities in quality companies. We can continue to expect that the KLCI has a bullish outlook this year.

After breaking through resistance, the China Hang Seng Index (HSI) has entered a short-to-medium-term technical bull market, with prices closing above 20% from the bear market low. Additionally, we observe a double bottom pattern, affirming that the worst is behind us. Confirmation of the new bull market will come with the 50-day moving average (50MA) crossing both the 150-day (150MA) and 200-day (200MA) moving averages. China's recovery is poised to significantly impact the commodity market and will also be advantageous for the Malaysian market and currency.

Keep reading with a 7-day free trial

Subscribe to Envision Malaysia 10X stock investment to keep reading this post and get 7 days of free access to the full post archives.