Although I generally remain skeptical about broad economic forecasts due to their inherent unpredictability, I do recognize the value in understanding economic and market cycles. Being aware of our current phase within a cycle can provide insights into future trends. This perspective is in line with Howard Marks' approach of "taking the temperature of the market" to gauge if it's overheated or underperforming. The strategy suggests investing when the market is undervalued and others are cautious, and exercising caution during periods of peak optimism to avoid the risks of overvaluation.

This article I will break this down into two parts: the first part will focus on the largest economy in the world, the US market, and the second part will focus on Malaysia. I will also discuss the current observations of the phenomenon known as the bubble. Looking ahead to 2025, I anticipate a combination of positive, negative, and challenging times. This expectation is based on our understanding of current cycles and trends, allowing us to prepare strategically for what lies ahead as investor.

U.S Market outlook for 2025

The US financial outlook for 2025 presents a mix of positive and negative factors that could influence market performance. On the positive side, market expectations are set for a strong initial performance, with the S&P projected to rise from around 6,000 to 7,000 by mid-next year. The market is still hot.

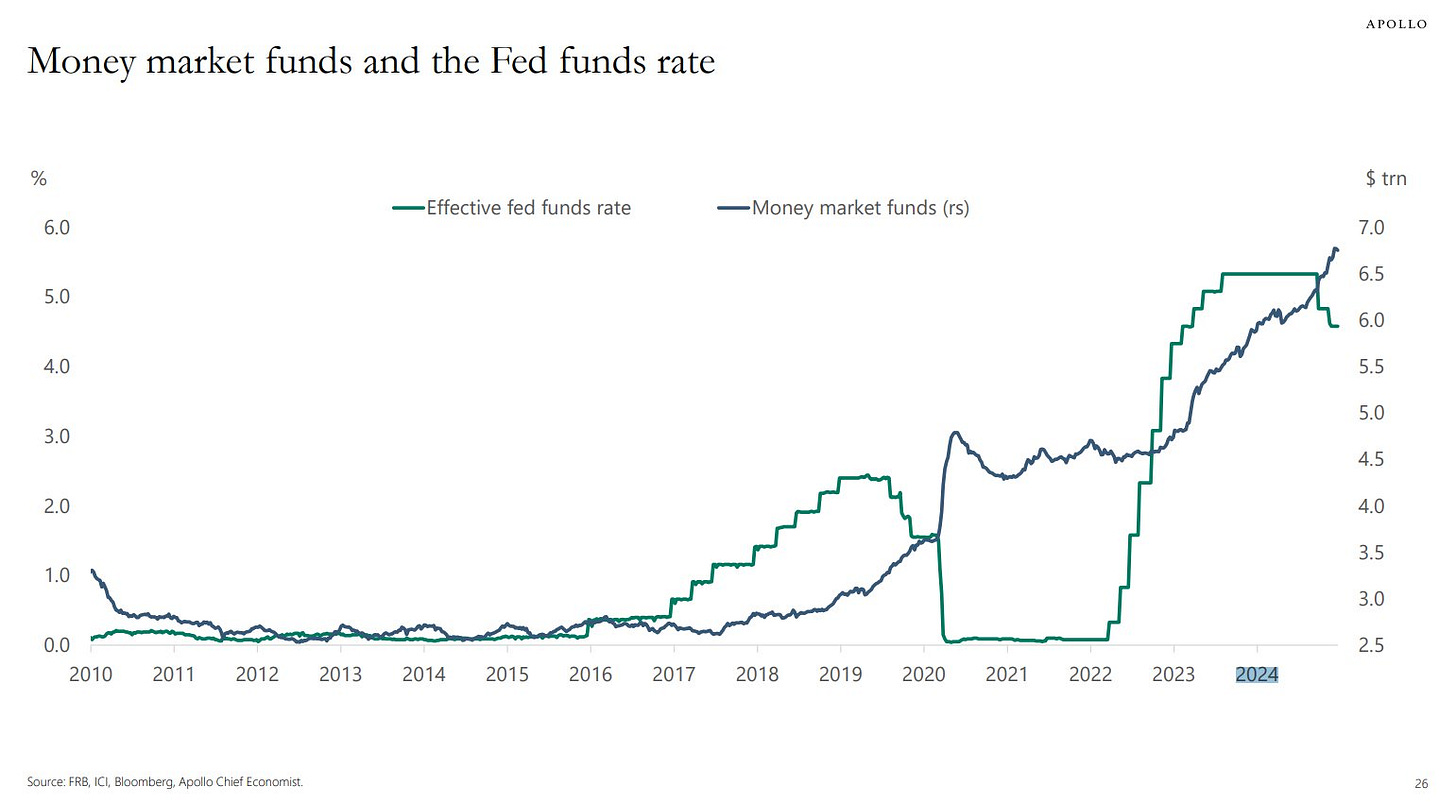

This optimism is supported by a dovish Federal Reserve, a pro-business incoming president, and substantial cash reserves on the sidelines, estimated at about $7 trillion this could be a strong fire power to the stock market. Additionally, robust employment and business conditions, along with technological advancements in AI, are expected to drive productivity and increase corporate EPS, particularly benefiting the technology and software industries.

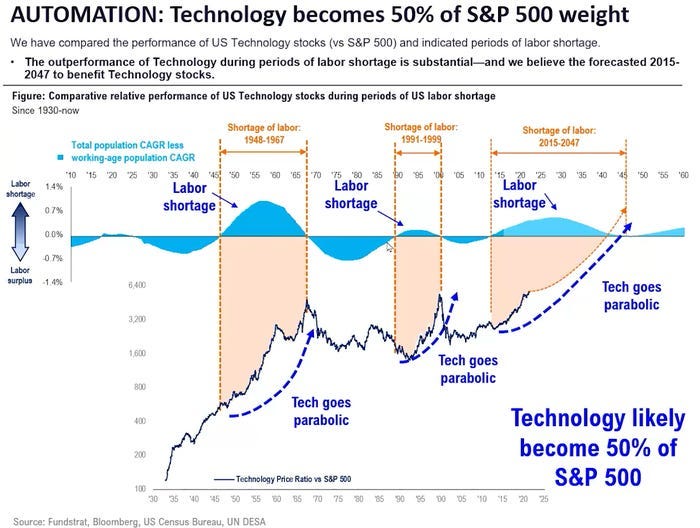

Since 2018, a global labor shortage, which we believed would trigger a wave of AI spending, has been observed. This phenomenon has occurred twice in history, from 1947 to 1954 and from 1991 to 1999. After World War II, there was indeed a shortage due to the high mortality rates caused by the fighting. During both periods, there was a shortage of prime-age workers, and technology stocks outperformed. This cycle is expected will continue through 2035, which is why market bullish on technology in the long term.

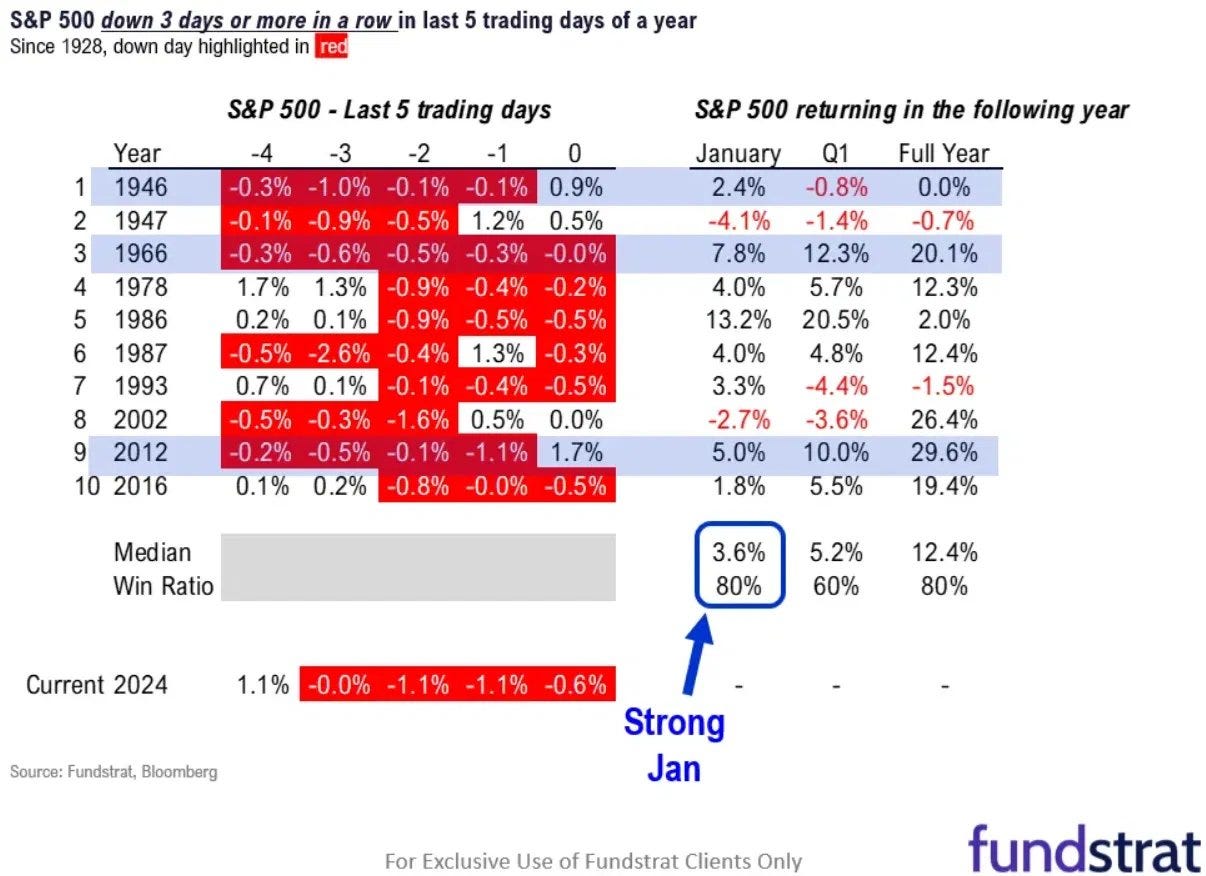

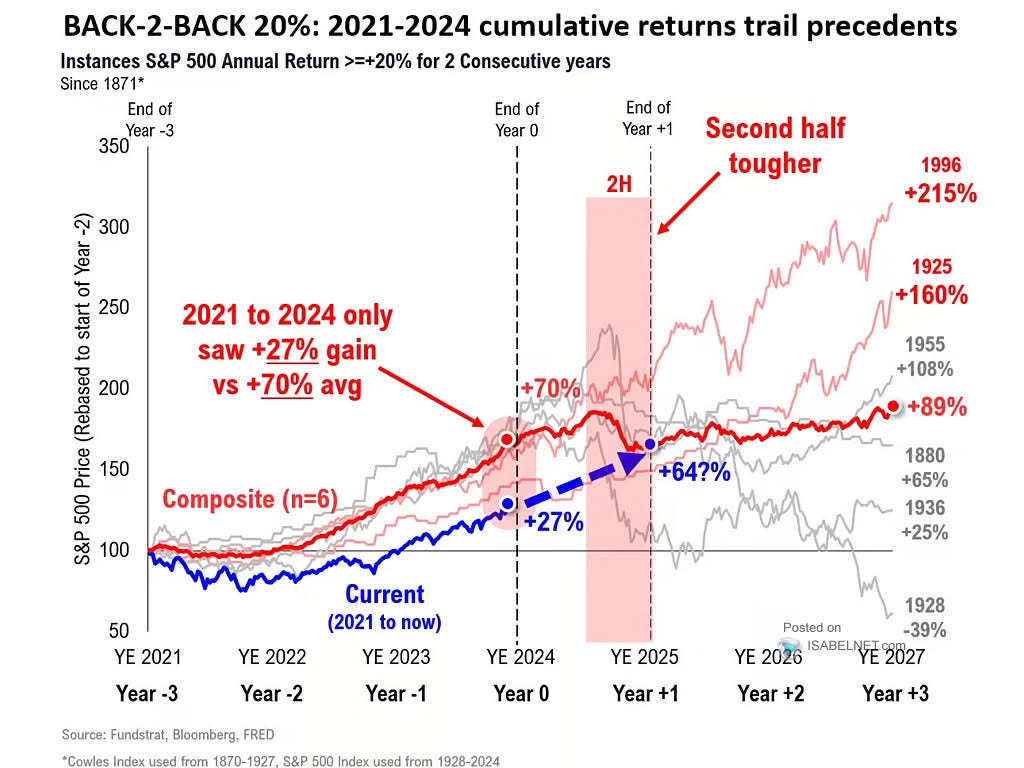

Since 1928, January still ends up with solid returns when the S&P 500 is down on three consecutive days during the last five trading days of the year, boasting an 80% success rate of achieving a positive return by year-end. Additionally, since 1870, there have been five instances where the major index experienced two consecutive years of 20% or more gains, and each time, the market performed poorly in the second half.

While history suggests we might see gains in the first half, the future could unfold differently. Concerns about market overheating and high valuations, such as those indicated by Shiller CAPE ratio currently 38.5 above 10 year average 26.40, make investors cautious. However, the high PE ratio is mainly affected by the 'Magnificent 7' stocks, which now reflect a near-record 31% of the S&P 500's performance.

Moreover, volatility is likely due to uncertainties surrounding interest rates, particularly with the Federal Reserve potentially delaying or reducing the pace of rate cuts. Currently, the fed funds rate is at 4.75%, with a neutral rate considered to be around 2.75%. This implies about eight cuts are needed, with only three expected this year, leaving five for the future.

Additionally, tariffs and political decisions could negatively impact market performance, complicating the effects on pricing and economic growth. There's also a persistent concern that tariffs might trigger inflation reduce the rate cut by fed. Nonetheless, if there are fewer rate cuts this year, it could leave more firepower for the economy later, possibly extending economic momentum into the near future.

Where is the Bubble?

Michael Cembalest, chief strategist at J.P. Morgan Asset Management, provides compelling data showing that the market capitalization of the seven largest S&P 500 components accounted for 32-33% of the index’s total capitalization at the end of October. This figure is roughly double the leaders’ share five years ago; and prior to the emergence of the “Magnificent Seven,” the highest share for the top seven stocks in the last 28 years was roughly 22% in 2000, at the height of the TMT bubble.

Moreover, it's notable that U.S. stocks constituted over 70% of the MSCI World Index at the end of November last year, the highest level since 1970. This indicates not only the high valuation of U.S. companies relative to those in other regions but also that the top seven U.S. stocks are disproportionately valued compared to the rest of the U.S. market. The question then arises:

Are we in a bubble?

Howard Marks gave a very good explanation of a bubble. He said, 'A bubble, more a psychological state than a quantifiable metric, reflects not just a rapid increase in stock prices but also a temporary mania characterized by extreme enthusiasm, a fear of missing out, and a conviction that no price is too high for certain stocks. This phenomenon often coincides with new innovations lacking historical valuation benchmarks, making them speculative and vulnerable to overestimation.

Keep reading with a 7-day free trial

Subscribe to Envision Malaysia 10X stock investment to keep reading this post and get 7 days of free access to the full post archives.