Buying things well requires an understanding of value that goes beyond numbers

As Howard Marks puts it:

"Success in investing doesn’t come from buying good things, but from buying things well. And buying things well requires an understanding of value that goes beyond numbers." — Howard Marks, The Most Important Thing

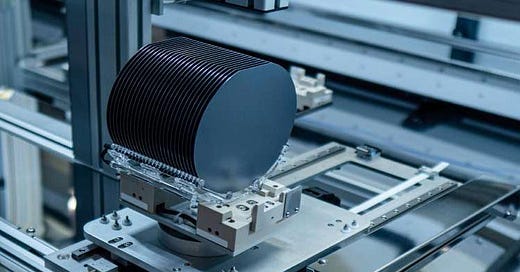

Investing isn't just about finding good companies; it’s about developing judgment, perspective, and understanding qualitative factors like management, culture, brand strength, and competitive advantages. Recently, the Malaysian tech sector has faced heavy selling pressure amid concerns over U.S. tariffs, especially on high-value semiconductor products. While this has made many tech stocks appear cheap, it also presents rare opportunities. In times like these, it’s critical to focus on what is truly important and knowable — often found in qualitative factors, which take time to fully understand.

This is an ideal moment to revisit a high-conviction investment we previously analyzed and ask:

Why will this company still be standing 5, 10, or 20 years from now?

What fundamental factors support its resilience?

How durable are these advantages?

By focusing on these questions, we can better identify investments that not only endure market cycles but emerge stronger from them.

Keep reading with a 7-day free trial

Subscribe to Envision Malaysia 10X stock investment to keep reading this post and get 7 days of free access to the full post archives.