Evaluating Promising Tech Ventures: Hillhouse Capital’s Approach

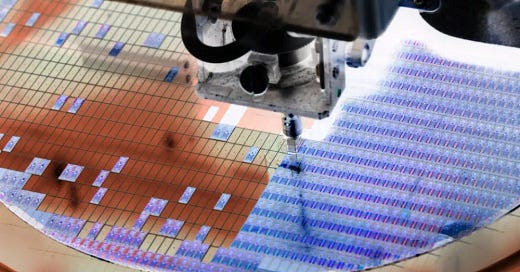

In the next five years, wafer manufacturing will focus more on advanced packaging technologies rather than process nodes.

Hillhouse Capital, founded by Zhang Lei, has become one of Asia's largest asset management institutions. Zhang Lei believes that the most crucial aspect of risk management is selecting the right people. He explains, "A first-rate individual will thrive in a third-rate business, whereas a third-rate individual will struggle in a first-rate business." This perspective suggests that choosing the right people, who then create the right organization within the right business environment, allows them to consistently contribute great value to society. If valuation can compoundly increase in the future, the safety margin becomes even greater. Zhang Lei places a strong emphasis on selecting individuals who possess broad vision and long-term strategic thinking.

In this review, we will follow Zhang Lei and Hillhouse Capital’s approach to evaluate one of the most promising tech companies based on its founder, organization, business environment, and business model. I will also explain why, in the next five years, wafer manufacturing will focus more on advanced packaging technologies rather than process nodes. This shift will create huge potential in the ATE market in Malaysia, particularly for this company. Finally, we will uncover its technical analysis and fundamental valuation to determine if it is the next potential 10x company.

Keep reading with a 7-day free trial

Subscribe to Envision Malaysia 10X stock investment to keep reading this post and get 7 days of free access to the full post archives.