Is Hartalega the Next Big Winner?

How Does Understanding the Industry and Capital Allocation Drive Investment Success

During the COVID-19 pandemic, glove companies enjoyed unprecedented profits, comparable to what they might expect over a decade, compressed into a short period. While some companies made mistakes by conducting excessive share buybacks when market prices were high, others prudently saved their cash reserves. Now, the challenge is to effectively use these surplus funds for future growth through smart capital allocation. The optimal strategy mimics a racing tactic: stick close in stable times and overtake during downturns. This prudent conservation sets them up to navigate future uncertainties and secure a stronger competitive advantage. Looking ahead, a key question: which company will continue to outperform the industry over the next 5 years? I believe Hartalega will continue to be a frontrunner. Now, let’s delve into their latest quarterly reports and discuss why Hartalega remains an attractive investment based on its valuation.

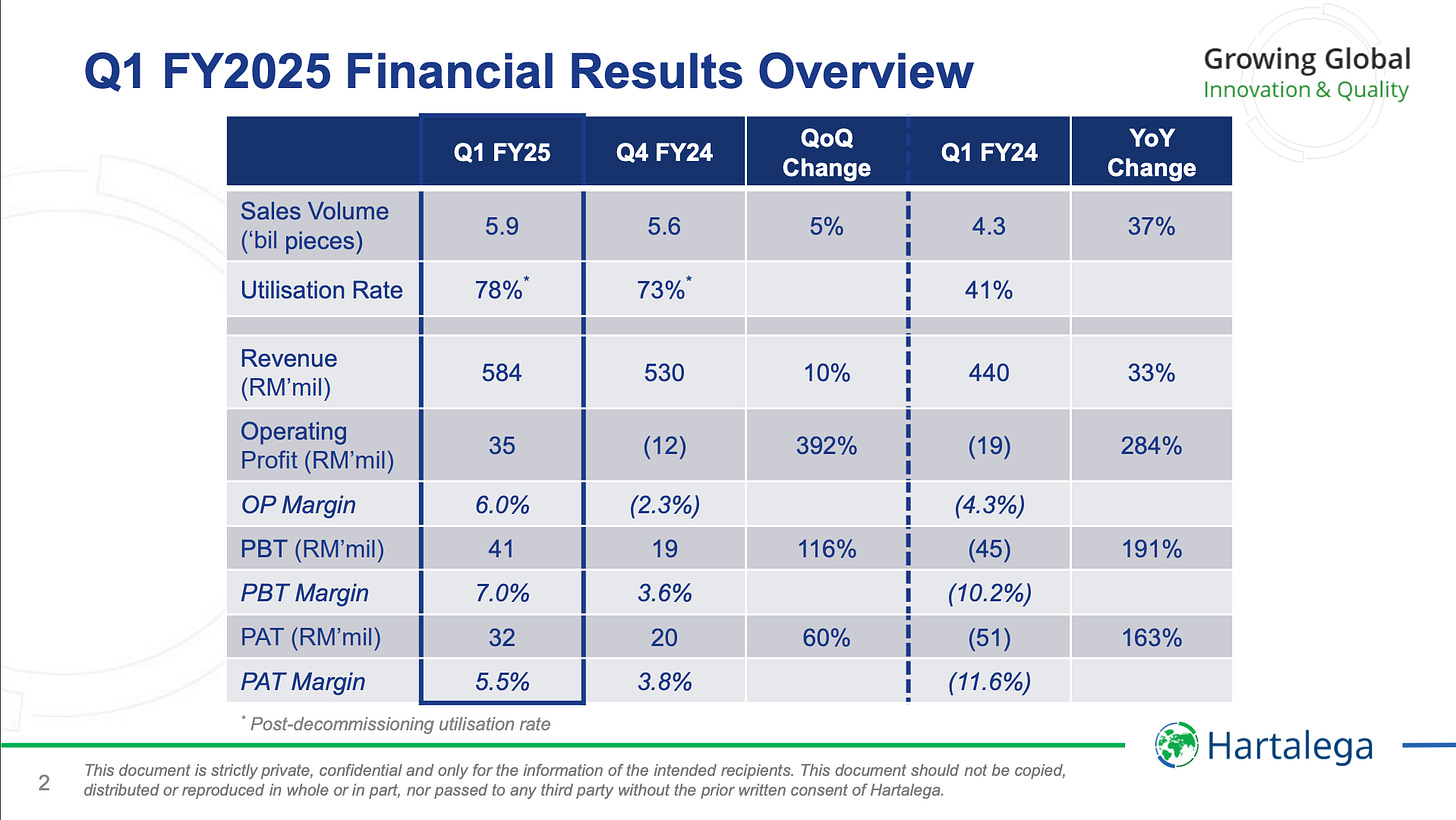

Latest QR Performance:

Hartalega's revenue for the first quarter of fiscal year 2025 increased by 10.2% quarter-on-quarter to RM583.8 million, primarily driven by a 5% rise in sales volume, reaching 5.9 billion pieces. However, there was a delay in shipping approximately 600 million pieces of gloves, which has been postponed to July 2024. The utilization rate also rose from 73% in the fourth quarter of fiscal year 2024 to 78% in this quarter. The company is planning to start the NGC1.5 expansion in the second quarter of fiscal year 2024 to boost its total capacity to 37 billion pieces per annum, in anticipation of rising demand. Additionally, the average selling price (ASP) saw a 4.2% increase to USD 21 per thousand pieces. Hartalega's core net profit for the first quarter of fiscal year 2025 was RM36.7 million, a significant recovery from a core net loss of RM1.5 million in the previous quarter, with profit before tax (PBT) jumping 118% to RM41.1 million.

Glove industry outlook:

Capital naturally flows towards high-return businesses and recedes when returns fall below the cost of capital. When returns are low and capital withdraws, competition decreases, leading to higher future profitability and valuations. The glove industry is currently in this phase of the capital cycle, as described by Edward Chancellor. Capacity rationalization by key domestic players has helped manage global oversupply, while many newer entrants have exited, further reducing pressure. These factors, along with a gradual recovery in demand and the depletion of pandemic stockpiles, are stabilizing the sector. Improved profitability and valuations are expected soon.

The longer-term prospects for the rubber glove sector remain positive. Historically, glove consumption has shown a healthy compounded annual growth rate of 6% to 8%, a trend that is expected to continue in the long run. Additionally, in light of the US-China geopolitical tensions, the announced hike in US tariffs on Chinese rubber medical and surgical gloves from 7.5% to 25.0% in 2026 could potentially provide further impetus for Malaysian glovemakers to regain market share in the US.

The hard trend suggests that there's a 2% annual probability of experiencing a pandemic similar to COVID-19. This likelihood, according to the Duke Global Health Institution, is increasing due to more global travel and significant environmental changes, which foster the emergence and spread of new infectious diseases. Over a 21-year period, this equates to about a 28.57% chance—essentially predicting that about 6 out of every 21 years could see pandemic conditions that may allow for exceptional profit opportunities in glove industry.

Continue innovative products provide pricing power, creating a sustainable competitive moat.

Hartalega - COATS Hydrating Nitrile Gloves, - 4x Hydration and sensitive, retail RM 325.40/ $73 per 1000 pcs

Hartalega - Antimicrobial Nitrile Gloves, - Kills Up To 99.999%, retail RM 203/ $45.60 per 1000 pcs

Kossan - BerryBlue Nitrile Disposable Glove - Reduce allergy, retail RM 169/ $38 per 1000 pcs

Top Glove - Nitrile Disposable Powder Free Glove, retail RM 110/ $24.70 per 1000 pcs

Hartalega has actively promoted its specialty value-added glove products, which feature patented innovations such as the Colloidal Oatmeal System (COATS®), along with biodegradable and antimicrobial gloves. These products, tailored to meet the evolving needs of customers, are priced significantly higher than standard nitrile disposable gloves. Market research indicates that Hartalega’s value-added gloves can command prices nearly 2-3 times higher than regular gloves. This demonstrates that retail customers are willing to pay a premium for these products, as the cost remains minimal for daily use while the benefits are substantial. For example, COATS Hydrating Nitrile Gloves can help prevent and alleviate hand hydration issues—problems for which many women might otherwise spend hundreds of dollars on hand-care products or treatments.

Additionally, Hartalega has focused on expanding its own-brand product portfolio and strengthening distribution through its MUN Global brand. By reducing reliance on middlemen, the company protects its profit margins. This strategic focus on innovation and brand development has empowered Hartalega to maintain pricing power, resulting in above-average profit margins and a higher Return on Invested Capital (ROIC) ratio within the industry.

Refer back to our previous analysis of the profit margins of different glove companies.

Hartalega: Saving Like a Pessimist, Investing Like an Optimist

Hartalega's 5-Year Strategic Plan

Hartalega has taken an aggressive and pioneering step by being the first in the industry to decommission on a large scale capacity. The company has rapidly adopted the latest technology in production, significantly enhancing efficiency. This has led to lower production costs at their Next Generation Integrated Glove Manufacturing Complex (NGC) in Sepang. Moving forward, Hartalega is poised to outpace its competitors in production efficiency and maintain profit margins well above the industry average in near future.

Hartalega: Closed its Bestari Jaya facility, which had a capacity of 13 billion, reducing total capacity by 30% to 31 billion, and is consolidating operations at the new NGC1.5 in Sepang.

Supermax: Closing three older plants, reducing output by 3 billion gloves annually, or 11% of its total capacity of 27.4 billion.

Kossan: Reduced its production by 3 billion gloves annually, or 8% of its total capacity of 33.5 billion.

Top Glove: Closed two plants, decreasing capacity by 5 billion gloves or 4% of its total.

Hartalega has been advancing through the Next Generation Integrated Glove Manufacturing Complex (NGC) in Sepang for the past decade, significantly boosting its production capacity 37bn pcs/annum this year and consistently surpassing industry efficiency benchmarks. The upcoming NGC 1.5 is set to achieve even higher production line efficiency levels compared to existing NGC plants, well above the industry average in Malaysia. As a pioneer in fostering an industry innovation culture, Hartalega continuously raises standards to strengthen their economic moats, affirming their reputation as a quality company. Furthermore, their sustained positive free cash flow, combined with a net cash position of 1.4 billion, will finance the next five years of growth without the need for debt or raising capital from shareholders, thereby preventing any dilution of shareholding and reduce financial risk.

Valuation

15 years cash per share Growth Rate 28%

10 years Median ROIC 19.13/ ROE 20.20/ ROCE 21.84

10 years Median WACC 8.39

We using ROIC as a better projection free cash flow growth rate as it measures how well a company generates cash flow relative to the capital it has invested in its business.

Keep reading with a 7-day free trial

Subscribe to Envision Malaysia 10X stock investment to keep reading this post and get 7 days of free access to the full post archives.