I still remember when The Big Short’s Michael Burry made headlines by tweeting a single word—“Sell”—in January 2023. It sparked panic across markets… only for him to later admit he was wrong after a surprising rally. The key takeaway? Never try to time the market.

Fast forward to today—the headlines are dominated by fears of a “Trump Trade War 2.0” and a possible recession, and once again, the instinct to sell is creeping in. But before reacting, it’s worth asking: Are these tariffs merely political posturing, and what is the real impact on business fundamentals? In this article, we’ll explore the motivations behind the new tariffs, how the situation might unfold, and—most importantly—what it all means for your investments.

President Trump is only leveraging reciprocal” tariffs as a negotiation chip, here is why:

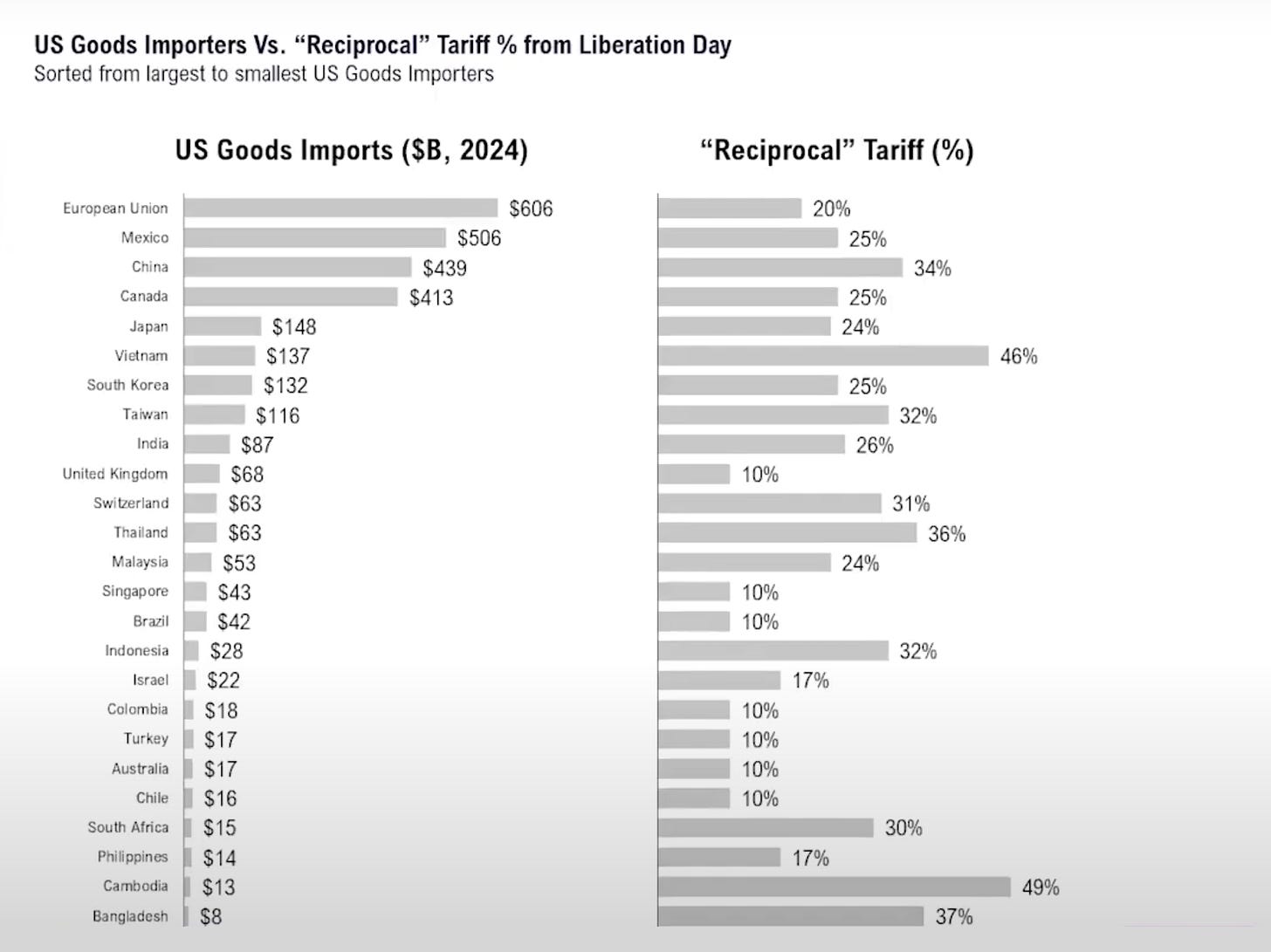

The unusual calculations of “reciprocal” tariffs—for instance, 67% for China and 40% for the EU—are not based on actual foreign tariffs (WTO reports China at 7.3% and the EU at 5.2%). Instead, they are derived from a peculiar method: the U.S. trade deficit divided by its imports:

The U.S. exports $148 billion to China and imports $427 billion, resulting in a $279 billion imbalance. This calculates to 65%.

The U.S. exports $27.6 billion to Malaysia and imports $52.5 billion, resulting in a $24.9 billion imbalance. This calculates to 47%.

The U.S. exports $17.7 billion to Thailand and imports $63.3 billion, resulting in a $45.6 billion imbalance. This calculates to 72%.

The White House has stated:

“Should any trading partner take significant steps to remedy non-reciprocal trade arrangements and align sufficiently with the United States on economic and national security matters, I may further modify the HTSUS to decrease or limit the scope of the duties imposed under this order.”

Tariffs of 10% will commence on April 5th, with “reciprocal rates” beginning on April 9th. Trump intentionally delayed the higher rate on the 9th to allow a short window for negotiation. Commerce Secretary Lutnick stated, “We’re not backing off.” Trump also gave an interview aboard Air Force One on Thursday evening after markets closed, saying, “Tariffs give us great power to negotiate.” He added, “Every country’s calling us. That’s the beauty of what we do—we’ve put ourselves in the driver’s seat. If we had asked countries to do us a favor, they would have said no. Now, they’re doing anything for us. The tariffs give us great power to negotiate.” The clear intention here is to use tariffs as a strategic bargaining tool to strike a deal.

The 10% base tariff rate is likely to be a new long-term measure. However, “reciprocal” tariffs serve as leverage to create a level playing field. The approach focuses on pressure rather than protectionism, aiming for freer, fairer trade that could help reverse the trade deficit.

Trump is particularly focused on six nations that account for 70% of the new tariff revenue—$582 billion out of a total of $846 billion, which includes 94 other countries. The key targets are the EU, China, Japan, South Korea, Canada, and Mexico. Currently, Japan, South Korea, Canada, and Mexico are already engaged in negotiations. The EU—particularly France and Germany—has also expressed intentions to retaliate. China on Friday announced retaliatory tariffs of 34% on U.S. imports, signaling a major escalation of the trade war initiated by Donald Trump and intensifying fears of a global recession. However, such a move would likely trigger further countermeasures, leading to even higher U.S. tariffs. As a result, it is highly probable that both China and the EU will eventually move toward reaching a deal at the end when near to the date.

There's a strong likelihood that these penalty tariffs will be short-lived. Why?

Recently, two dozen trade experts convened at the Center for a New American Security to simulate the outcomes of a global trade war. The results were unexpectedly optimistic. During the simulation, the escalation of tariffs heightened international tensions, threatened jobs, and spurred inflation. However, by the end of the session, many punitive measures had been withdrawn. The European representatives agreed to lower some trade barriers in exchange for Trump's reduction of certain tariffs. This led the United States to lift many of its tariffs on Canada and Mexico and to refresh its trade agreements.

Emily Kilcrease, a senior fellow at the think tank, portrayed Mr. Trump during the simulation and noted that the scenario suggested a viable, but high-risk, path to success for a U.S. tariff-first policy. “The U.S. is still very much in the driver's seat, and when the U.S. acts, everyone else has to respond,” Mr. Gertz said. For more detailed insights, you can read the full article on the New York Times.

Therefore, Trump’s strategy with “reciprocal” tariffs is aimed at facilitating bilateral trade agreements. Before 9 April the implementation day, the Mr market is panic on the potential trade war 2.0 and also recession after tariff in place create a huge sell-down and S&P 500 VIX index shoot up to 45.31 on Friday. There is a high probability that these punitive tariffs will be short-lived, presenting an excellent opportunity for investors to buy misplacing, undervalued and high-quality companies.

Returning to the subject of investment

It's crucial to hold the mindset that purchasing shares is equivalent to buying into a company business. Understanding the fundamentals of the company is paramount. Generally, if companies not focused on the U.S. market experience minimal impacts. When Mr. Market reacts in panic and offers shares at mark-down prices, it's an opportunity for you to capitalize. Being confident and decisive is possible when you deeply understand the business and ensure it falls within your circle of competence. Purchasing quality companies at substantial discounts (margin of safety) can yield excellent returns, as value reversion is just matter of time.

Here are the most important—yet simple—rules of investing, which are often the hardest to follow:

Buying shares means owning a piece of a business—focus on the company's fundamentals.

Stay within your circle of competence so you can make a few high-conviction bets with a strong win rate.

Take advantage of Mr. Market's emotional swings—Market is to serve, not guide you.

Always buy with a significant margin of safety— extra protection.

Be patient and wait for value to be recognized—reversion to the mean takes time.

By now, you should already have a buy list with fair value estimates for each company, a solid understanding of the businesses, and be ready to deploy your cash if the market declines further in the coming days.

Now is the time to get busy. Feel free to read back to all the quality companies I've covered previously to help you compile your buy list.

Charlie Munger: "Opportunity comes to the prepared mind."

Wishing you all happy investing

Disclaimer: The information provided in this article is based on my personal analysis and should not be considered as financial or investment advice. Readers are advised to conduct their own research and seek professional guidance before making any investment decisions. The accuracy and reliability of the information cannot be guaranteed, and I assume no responsibility for any losses or damages incurred. Investing in stocks involves risks, and past performance is not indicative of future results.