Sell Oil Stocks? OPEC+ Floods the Market Amid Oil Price Crash

where is the next wave of opportunities may emerge for investors

Howard Marks once wrote, “No cycle occurs in a vacuum or ends cleanly at the border with the next. They overlap and interact.” This insight is particularly relevant as we examine the recent OPEC+ decision to implement another modest production increase for June. The move highlights the complex interplay between supply adjustments, shifting global demand, and broader economic uncertainty. In this article, we explore the turning tide in the oil market, assess where the overlapping cycles may be steering us next, and delve into the where is the potential investment opportunities emerging within the Malaysia oil and gas sector.

Focus on the Supply Side

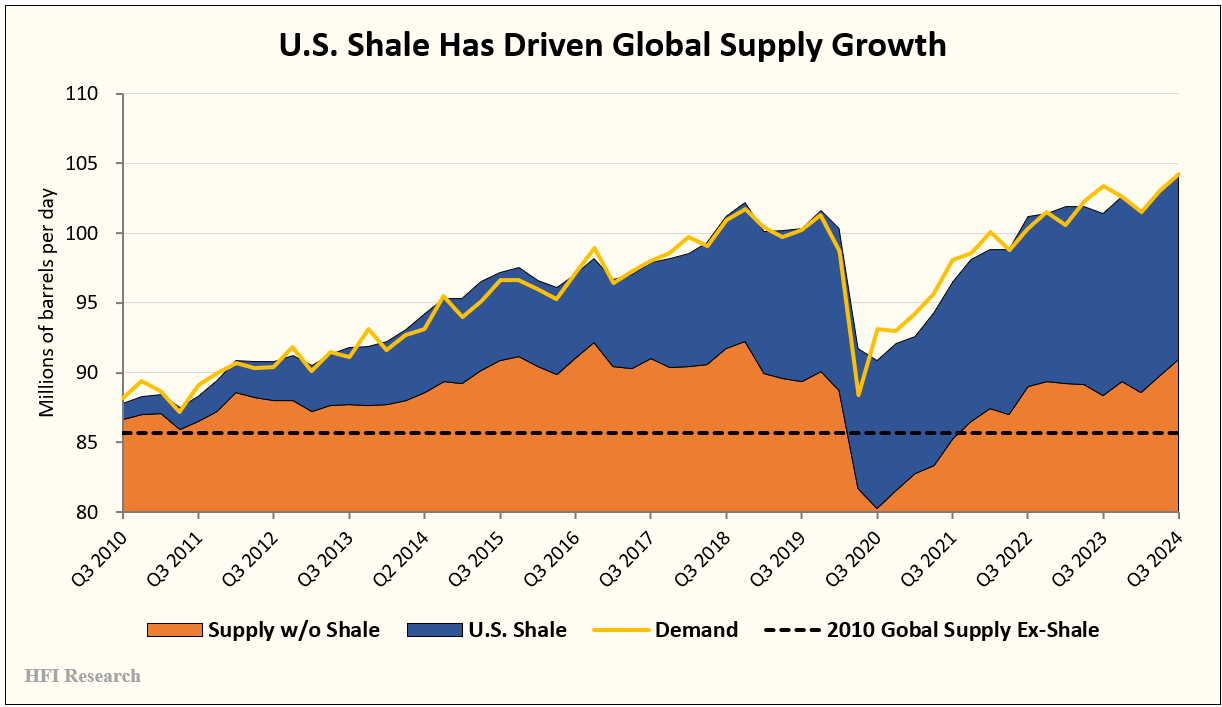

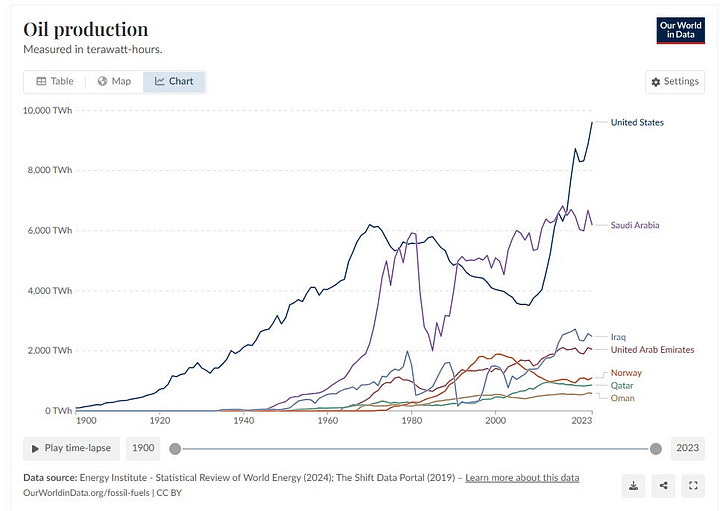

Over the past decade, the story of global oil production has largely been about the U.S. After a steep 50% decline in production from the 1970s, the U.S. reversed course in the 2000s to become the world’s top oil producer. This turnaround was mainly driven by the shale oil boom, where output grew from virtually nothing to 10 million barrels per day in just over a decade. While this surge boosted global supply, it also kept oil prices under pressure—except during the brief post-COVID rebound. When adjusted for inflation, oil prices have barely moved since the early 2000s.

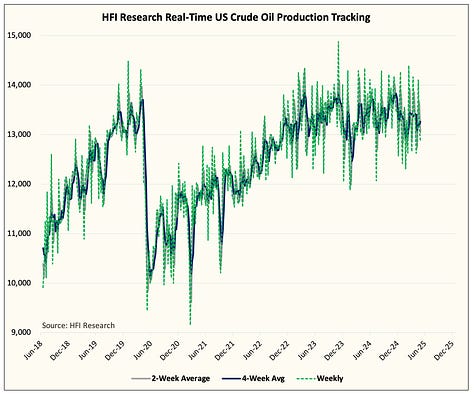

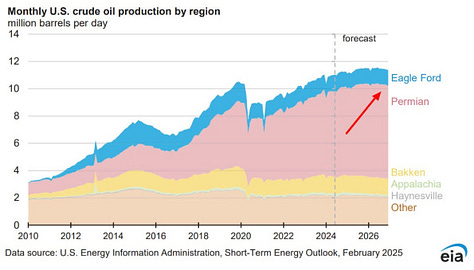

U.S. Shale Production Is Peaking

Today, U.S. shale output appears to be hitting a ceiling. Growth is expected to slow significantly through 2025, signaling the end of its expansion phase. This slowdown stems from the depletion of high-quality (Tier 1) drilling sites. In an interview with CNBC, former Pioneer Natural Resources CEO Scott Sheffield revealed that running out of Tier 1 inventory was a key reason for selling the company to ExxonMobil.

He said, “We were running out of Tier 1 inventory. Everybody is running out of Tier 1 inventory.”

Sheffield noted that Pioneer’s Tier 1 sites would be used up by 2028, and Tier 2 by 2032. This ties into industry-wide concerns about declining well productivity and rising costs, especially in the Permian Basin. The breakeven cost of production is another challenge—Sheffield pegged cash breakeven at $50–$55 per barrel, while industry data shows that operations in the Midland Basin (A major contributor to U.S. crude oil and natural gas production account 48% of total U.S. crude oil production) need around $61 per barrel to break even. Below this level, the price is not sustainable and will further discourage Capex investment.

OPEC+’s Next Move

On May 3, OPEC+ announced a modest production increase for June and hinted at faster increases through the rest of 2025. With concerns around demand due to a potential tariff war and faster supply growth, many investors have grown cautious about the oil market. The oil price also fell to the $60 level range.

But perception and reality aren’t lining up. Despite the announced increase, crude exports in May — OPEC+’s first month of ramping up — are trending lower. Saudi Arabia, in particular, has exported less oil than expected. Because these production adjustments are voluntary, Saudi Arabia can announce an increase publicly while still keeping exports tight behind the scenes. Or did they just forget to flood the market?

The Strategic Play

There may be a political angle too. By "increasing" production, Saudi Arabia may be signaling cooperation to the U.S. (especially to Trump), while in reality keeping exports low to support prices. This also puts pressure on U.S. shale producers, just as demand uncertainty makes investors nervous. In turn, this leads to capex cuts - Matador Resources Co., Dallas, is trimming 2025 drilling and completion plans, has already announced a $100 million reduction and cut its rigs from nine to eight.

This supply discipline benefits Saudi Arabia. Despite the headlines, physical oil inventories could stay tight, supporting higher prices. Plus, by limiting how fast production increases actually happen, OPEC+ can keep internal "cheaters" in check and maintain better group cohesion.

From a sentiment angle, this could cap oil prices as we enter the summer demand season. And if current supply-demand models hold true, oil inventories will remain tight—frustrating oil bears and eventually widening the gap between market perception and underlying fundamentals. At some point, that disconnect will become too obvious to ignore.

But Demand Is Still Growing

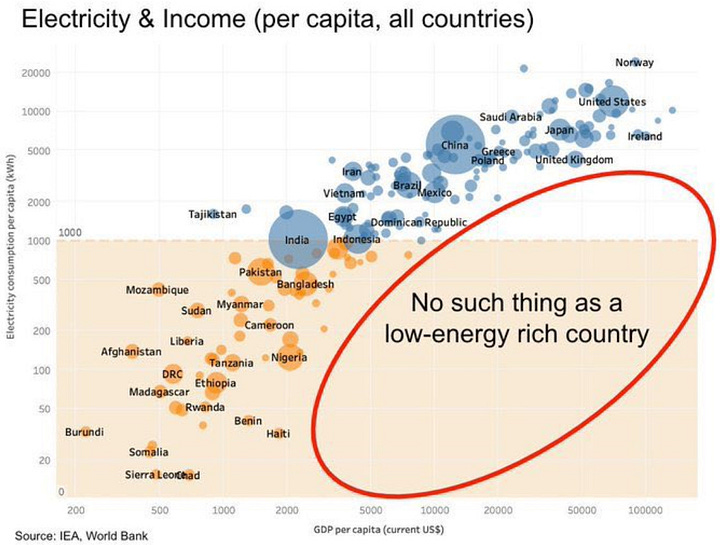

Despite what headlines may suggest about net-zero goals, electric vehicles, and phasing out fossil fuels, the truth is this: we’re not undergoing an energy transition—we’re experiencing energy addition. As the chart shows, global oil demand keeps rising, along with overall energy use. There’s no such thing as a wealthy, low-energy society. As countries like China, India, Southeast Asia, and South America—which together make up over 50% of the world’s population—climb the economic ladder, their per capita oil consumption will trend closer to that of developed nations. The direction of oil demand? It’s only going up maybe in near future is slower down.

Where We Are Headed

From the start, the OPEC+ production cuts were never truly collective—they’ve always been driven by Saudi Arabia. Despite announcements of a faster production increase, there’s been no real rise in OPEC+ crude exports, largely because Saudi Arabia continues to hold back. At the same time, U.S. crude production is showing signs of weakness, global oil inventories remain tight and while demand is soft but still growing in long-term, it’s far from collapsing. Yet WTI crude remains stuck around $60, but this level is not sustainable. This production “increase” is largely symbolic. The market’s bearish reaction is driven by perception, not fundamentals—discouraging Capex and risking future supply shortages. Until the reality of constrained supply becomes clear, the disconnect between perception and reality will continue to weigh on prices and frustrate investors.

Keep reading with a 7-day free trial

Subscribe to Envision Malaysia 10X stock investment to keep reading this post and get 7 days of free access to the full post archives.