The 100-Bagger Blueprint: Navigating the Path to Exponential Wealth

Unveil the Proven Strategies of Mohnish Pabrai and Thomas W. Phelps for Unprecedented Financial Growth

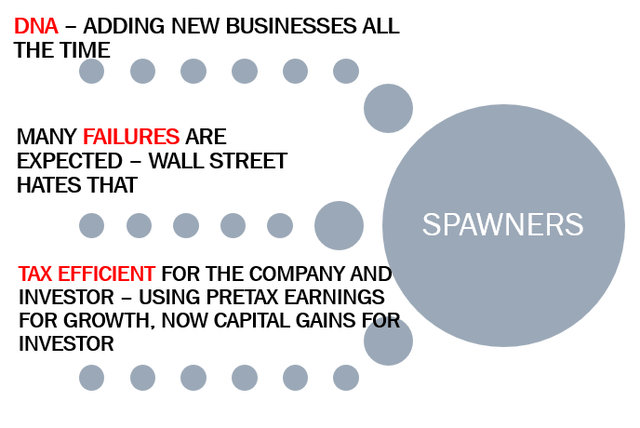

Identifying a company poised to grow tenfold to a hundredfold is considered the holy grail of value investing. Renowned investor Mohnish Pabrai's Spawner Stocks Framework, coupled with insights from Thomas W. Phelps' book "100 to 1 in the Stock Market," has established a proven track record of multiplying wealth through value investing. A key strategy involves identifying "Spawners," companies with the inherent capability to incubate and develop new, potentially unrelated, businesses into major growth drivers, aiming to achieve a 100x return.

The advantage of spawners lies in their ability to utilize pre-tax earnings for growth. By aggressively reinvesting earnings, these companies can enhance their intrinsic value without incurring the tax burden. For instance, Amazon's minimal reported earnings and negligible tax payments stem from its aggressive reinvestment strategy, a stark contrast to the 24% tax liability on earnings that would otherwise be incurred. Unlike share buybacks or acquisitions, which use after-tax earnings, spawners reinvest earnings before tax.

This article delves into the 100x Framework, as revealed by Mohnish Pabrai and Thomas W. Phelps, examining potential spawners within Envision portfolio. Unlike conventional screening methods, understanding these companies requires deep business insights. My portfolio includes two potential spawners, which I will elaborate on.

Keep reading with a 7-day free trial

Subscribe to Envision Malaysia 10X stock investment to keep reading this post and get 7 days of free access to the full post archives.