Rising with the Tide: The Company's Resurgence in the 2024 Oil Cycle Uptrend

Evaluating Velesto's Investment Potential Through 3 Key leading Indicators

In the third quarter of fiscal year 2023, Velesto Energy Bhd experienced a significant financial shift. The company's net profit dropped sharply by 91.9% to RM1.22 million from RM14.97 million in the same period of the previous year, despite an increase in revenue. This decline was primarily due to increased operating and finance costs. Interestingly, the company's share price showed an upward trend after the announcement, a development that left many investors puzzled considering the profit downturn. This analysis seeks to uncover the factors behind this surprising market reaction and highlight three key indicators for identifying profitable ventures in this cyclical business sector. If you've been following my blog, you're aware that I've been tracking Velesto as a potential turnaround opportunity. My initial investment in Velesto last year at 0.14 led to a 64% unrealised profit at the current price of 0.23, thanks to these key leading indicators, which I will discuss in more detail shortly. Let's delve into the details.

Recent Performance Analysis:

The market had largely anticipated poor results for 3Q23, expecting negative earnings. However, Velesto's net profit of 1.2 million exceeded many of these forecasts. The quarter was marked by planned downtime for three of its rigs, which impacted overall performance. The core net profit stood at MYR1.2 million, representing a decrease of 93% quarter-over-quarter and 92% year-over-year. This brought the 9-month core earnings of 2023 to MYR32.8 million, a notable improvement from the MYR74.4 million loss in the corresponding period of 2022.

Surprisingly, the company achieved a higher-than-expected blended utilisation rate of approximately 62% in 3Q23, surpassing analysts’ estimates of 53%.

This decrease in utilisation from 88% in 2Q23 was attributed to scheduled maintenance and upgrades, including repair works for Naga 2, a Special Periodic Survey for Naga 4, and underwater inspections for Naga 3. Velesto utilized this downtime to enhance rig technology with Offline Capabilities, NOVOS, and Starlink, aiming to improve rig marketability and secure higher Daily Charter Rates (DCRs).

A significant highlight for 3Q23 was Velesto's effective execution of Integrated Rig, Drilling, and Completion (i-RDC) services for Hess Malaysia. This project involved work on 14 wells in Block PM 302, in collaboration with Halliburton. The i-RDC venture yielded an after-tax profit of RM6.99 million for 3Q23, a substantial recovery from an after-tax loss of RM7.1 million in 2Q23, thanks to faster work progress. This improvement significantly mitigated the quarter-on-quarter decline in drilling pre-tax profit, which was RM6.16 million for 3Q23, compared to RM43.28 million in 2Q23.

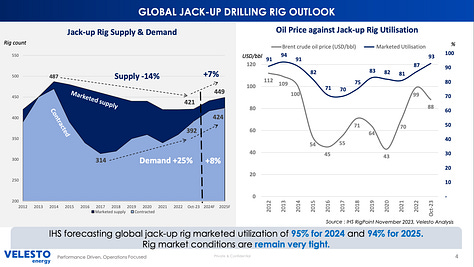

The Daily Charter Rate (DCR) for Velesto in the third quarter of 2023 (3Q23) rose to USD97k, a notable increase from the previous quarter's USD94k and the highest since 2015. Velesto recently successfully renegotiated the Naga 8 drilling contract, securing a rate of USD135k/day for an 18-month period with Petronas. In light of the tight market supply, Velesto is strategically positioned to acquire new contracts for Naga 2, 4, and 5, with the expectation of securing DCRs surpassing 135k/day before these contracts end by the second quarter of 2024 (2Q24). The group finds short-term contracts particularly advantageous as they capitalize on the continuously rising DCR, more closely matching current market rates. The latest fixture rates in Malaysia have escalated to approximately USD145k/day, rapidly closing in on the Southeast Asia average of USD165k/day. With a robust jack-up marketed utilisation rate of 100% in Southeast Asia and Malaysia, combined with the trend of increasing charter rates, Velesto is proactively engaging in contract renewals and seeking new contracts at elevated rates for 2024.

The market outlook:

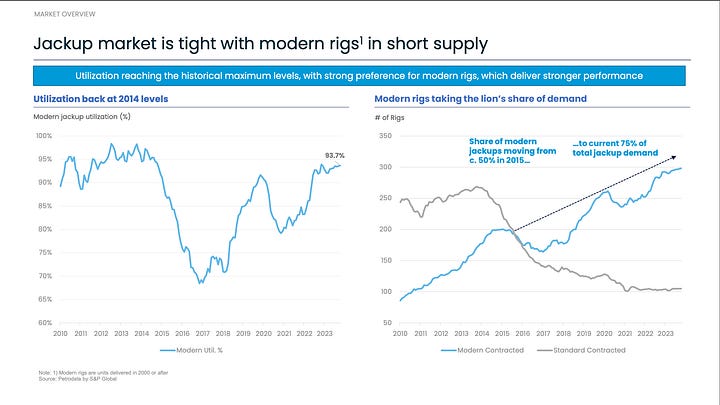

The jack-up rig market is facing constraints due to a diminishing fleet and many units operating for over three decades. Since the 2014 downturn, companies, particularly those with high debt, are hesitant to invest in new rigs. The new build order book is at a historic low, accounting for only 5% of the fleet. A new rig, priced at $300 million, requires a day rate of $230,000/day for a 15% return, which is 40% higher than the current market rate of $164,000/day. Since the peak in 2014, the jack-up rig supply has decreased by 11% due to lower reinvestment rates. Modern rigs, built after the year 2000, command higher day rates. Today, these modern rigs make up 75% of the global operating jack-up fleet and are tracking a global utilization of approximately 94%. As of September 2023, current demand leaves only about 12 marketable rigs in the market. The combination of increased competition, an aging fleet with many rigs over 30 years old nearing retirement, and a generally cautious investment strategy is likely to exacerbate the tightness in rig availability.

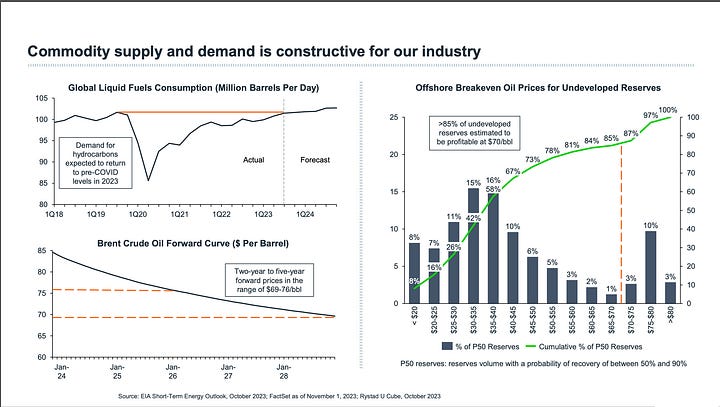

Demand-side analysis for the offshore oil and gas industry indicates a strong growth trajectory for shallow water drilling. It is highlighted as a cost-effective segment with low breakeven prices, drawing particular interest from Middle Eastern producers. As global fuel consumption is forecast to return to pre-pandemic levels by 2023, shallow water operations are poised to be profitable, especially with oil prices stabilizing between $69 and $76 per barrel, and 85% of undeveloped reserves estimated to be profitable at $70/bbl. Jack-up rigs, essential for shallow water drilling, have shown resilient demand, outperforming other drilling units. With shallow water drilling accounting for a significant portion of offshore production, the sector is expected to remain a lucrative focus for the industry, bolstered by favorable economic conditions and the recovery of global energy demand.

Keep reading with a 7-day free trial

Subscribe to Envision Malaysia 10X stock investment to keep reading this post and get 7 days of free access to the full post archives.