The Best Strategy Isn't the Highest Return, But One You Can Stick With Even in Bad Times

For New and Existing Subscribers: How to Replicate Envision Portfolio Returns

For New and Existing Subscribers: How to Replicate Envision Portfolio Returns. At the time of writing, the Envision portfolio has nearly grown to 1.74X times its initial value in one and a half years since inception last year Jan 2023 , with an initial capital of 100K and an additional 12K added (including reinvested dividends) during the last correction in April (referring back to my previous article “All You Need is Patience”). As the number of paid subscribers increased, many tried to replicate the Envision portfolio. I realized that some insights need to be shared here to help increase your prospective returns.

To my own envision fund, adding new funds has a dilutive effect. Similarly, a new subscriber who intends to replicate the Envision portfolio might not achieve the same results. Now, as a "new fund," what can we do?

There are three alternatives:

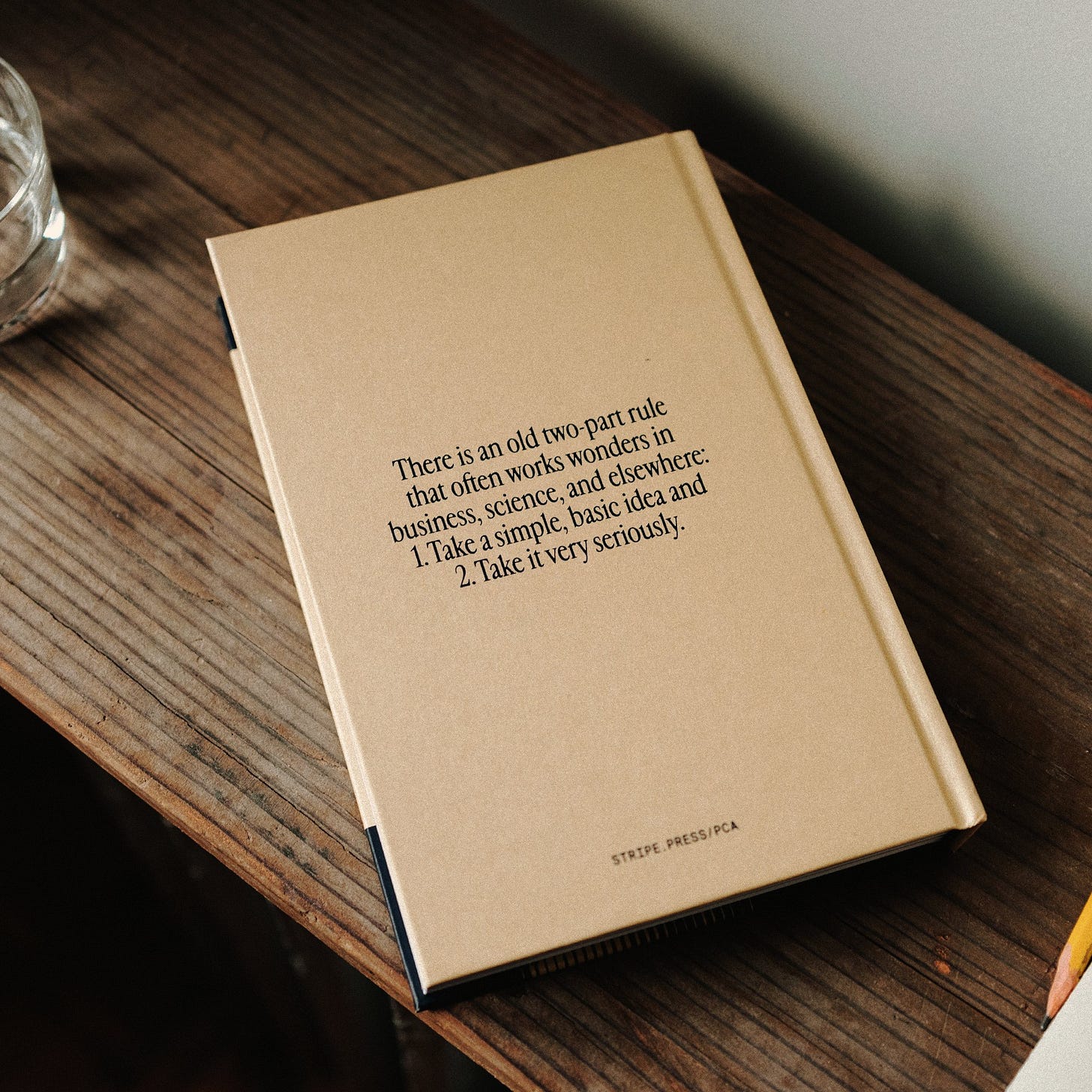

First, Place cash on deposit until suitable investments can be found. This requires patience, and you may feel like you're missing out on profits that others are making in bull market. This can be particularly challenging for new investors, leading to a higher risk of succumbing to the Fear of Missing Out (FOMO). Don't rely too heavily on your instincts, as people often underestimate the impact of their environment on their behavior. As Charlie Munger said, “The world is not driven by greed. It’s driven by envy.” I agree: FOMO is a major force driving the markets to the peak.

Second, buy a little of everything to replicate the existing Envision portfolio. This approach is appealing because it is easy and maintains overall potential returns. However, it has a major drawback: as prices rise, future returns decrease. For instance, if a business is worth RM 5.0, buying shares at RM 4.0 is less advantageous than buying them at RM 2.50. It also has less protection on downside. We put a lot of effort into maintaining our purchase decisions as buying a dollar for fifty cents, and don't want them compromised by buying at higher prices due to new funds. This strategy also risks shifting the investment decision back to the new investor, who may not realize they are acting as a stock picker.

Third, engage new funds with new and existing investment opportunities with only high margin of safety, with the option to defer acquiring more funds as needed. This strategy is superior because new funding is invested in undervalued assets, improving the price-to-value ratio of the overall portfolio. In this way, new funds add value to the overall fund. This is also what a new investor trying to replicate the envisioned portfolio can do. We estimate that we can find new investments in 2-3 months, though this may be optimistic; it really depends on the market cycle.

Let me illustrate the third option with a simple example below:

For example, you have a stock in your portfolio with a 50% Margin of Safety (MOS) and a prospective return of 100% when the price matches the fair value at the end. By adding another stock with equal weighting (50/50) but with a 60% MOS, your overall portfolio's prospective return increases to 125% from 100%, with lower risk. However, if you add new shares with only a 30% MOS, your overall prospective return will decrease to 71.42%, exposing you to higher risk.

Initial Portfolio:

One stock with a 50% Margin of Safety (MOS) and a 100% prospective return.

Value ratio: 50c on the dollar

Adding Shares with only 20% MOS:

New portfolio: Two stocks, each weighted equally (50/50).

If the second stock has a lower return due to its 20% MOS, it gives a 25% prospective return.

Combined return: (100%+25%)/ 2= 62.50%

Value ratio: (80%+50%)/2 = 65c on the dollar

This decreases the overall return from 100% to only 62.50% and increases risk from 50c to 65c on the dollar.

Adding a Second Stock with 60% MOS:

New portfolio: Two stocks, each weighted equally (50/50).

If the second stock has a higher return due to its 60% MOS, it gives a 150% prospective return.

Portfolio prospective return: (100%+150%)/ 2=125%,

Value ratio: (40%+50%)/2 = 45c on the dollar

This increases the overall return and reduces risk.

So don’t chase the "hot" stocks. Being a heat seeking investor typically means you won't have a margin of safety. Expose higher risk but limit your prospective return.

Now, let’s review what we covered in my previous analysis and compare the current margin of safety based on the high fair value in a bull market condition:

Keep reading with a 7-day free trial

Subscribe to Envision Malaysia 10X stock investment to keep reading this post and get 7 days of free access to the full post archives.