The Million, or Perhaps Multi-Million Dollar Question: What Is the Right Way to Evaluate a Company's Intrinsic Value?

During the pandemic, demand for products surged, driving up prices and valuations, especially in sectors like semiconductors. Despite a post-pandemic industry downturn, many tech stocks remain elevated due to the hype around generative AI. However, recent declines in stock prices have raised concerns about the sustainability of high price-to-earnings (PE) ratios, which don’t fully account for factors like debt, growth prospects, and management quality. This article explores how to properly evaluate a company’s intrinsic value and the key factors that influence valuations.

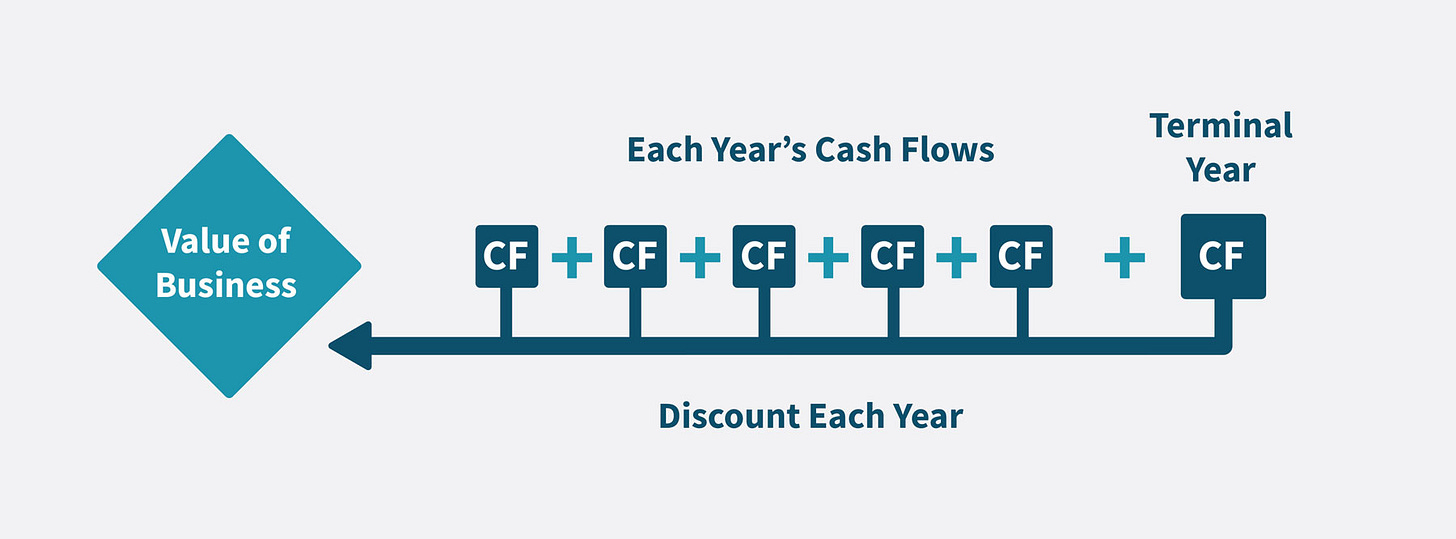

Discounted Cash flow

There is one and only reason to buy a financial asset is for its future cash flows. The Intrinsic value can be derived from the discounted value of the cash that can be extracted from a business over its remaining life. However, It is inherently subjective, as it fluctuates based on future cash flow estimates, growth rate and interest rates. Despite its subjectivity, intrinsic value is crucial for assessing investments and businesses. And most reliable method to evaluate the intrinsic value of the business.

John Burr Williams introduced the idea that a stock, bond, or business's value today is based on its future cash inflows and outflows, discounted at an appropriate rate. The key difference between stocks and bonds is that bonds have set future cash flows, while stock analysts must estimate them, with management quality playing a significant role in equity performance.

A company’s value depends largely on how well its managers allocate capital. Successful businesses often generate more cash than needed and can return it to shareholders via dividends or buybacks. The ideal business is one that can invest large amounts of capital at high returns over time, while the worst continually invests more capital for low returns. High-return businesses typically require less capital, so paying dividends or repurchasing shares benefits shareholders.

Evaluating equities isn't mathematically difficult, but even skilled analysts can make errors in estimating future cash flows. we need to address this by focusing on businesses that are simple and stable, which we can understand and within our circle of competent as Warren Buffett always stresses. Recognizing the limits of our knowledge is crucial, as successful investing requires avoiding major mistakes rather than knowing everything. Additionally, we adhere to a "margin of safety" principle, meaning we only invest when a stock's value significantly exceeds its price. This concept, emphasized by Ben Graham, is key to long-term investment success.

How to select the right company?

To select the right company for valuation, the focus should be on identifying businesses with strong prospects for sustained growth in free cash flow. The key is predicting whether managers can continue to deliver exceptional returns in what might seem like ordinary businesses. The most valuable companies typically have several defining characteristics: they are founder-led, operate in large markets with long-term potential, resist technological disruption and shifts in consumer preferences, have high barriers to entry (ensuring longevity), and require minimal capital investment, allowing for strong free cash flow generation.

Founder-led companies

I agree with Zhang Lei of Hillhouse Capital that the most critical element of risk management is selecting the right people. A first-rate individual can succeed in a third-rate business, while a third-rate individual will struggle even in a first-rate company. Founder-led companies, in particular, often outperform their non-founder counterparts due to several key advantages. Founders bring deep emotional and financial investment, aligning themselves with long-term goals and sustainable growth over short-term gains. Their innovative approach drives industry disruption, and their deep understanding of the business and market enables better strategic decisions, leading to superior asset allocation, stronger revenue growth, profitability, and stock performance.

Refer back to the previous articles:

Evaluating Promising Tech Ventures: Hillhouse Capital’s Approach

Part 2: Evaluating Promising Tech Ventures: Hillhouse Capital’s Approach

Notably, founders like Jeff Bezos and Warren Buffett derive intrinsic satisfaction from the challenges and creativity of their work, rather than relying solely on financial incentives. While financial rewards are important, they may not be the primary motivator for individuals at this level. Another crucial factor in a company’s success is its culture, often shaped and led by the founder from the firm’s inception. A competitive advantage doesn't have to rely on a single major factor; instead, it can be built on a series of interconnected, self-reinforcing actions that inherent in the culture. Let take scale economics business as example: To better an incumbent’s cost base a rival would have to be superior at, not one thing, but a million little actions – a far harder task.

Barriers to entry

Businesses with high barriers to entry can avoid the negative effects of the capital cycle, where capital flows in as returns rise and exits when returns decline, as highlighted by Edward Chancellor. A firm's profitability is threatened by worsening competitive conditions, but maintaining a strong competitive advantage helps mitigate these risks. Capitalism, by nature, is relentless—every company eventually fades; nothing lasts forever. Our task is to identify those that can endure the longest and bring their entire future cash flow to present value.

By analyzing Porter’s “five forces” (supplier and buyer bargaining power, threat of substitutes, rivalry, and new entrants), we can better understand a company's competitive position. For example, niche companies like Supercomnet Technologies Berhad (Scomnet), which produces medical cables, have delivered high returns due to low capital intensity and high margins in the medical device sector.

Over the past five years, the company’s operational margins ranged from 20-26%. The capital intensity required to achieve these impressive returns has been relatively low, with a Capex-to-sales ratio of only 0.03-0.04 over the last five years. This low capital intensity has allowed for consistently high free cash flow conversion, averaging over 85% of net income. In addition to robust margins, the company has experienced strong sales growth, driven by the integration of advanced technology into medical devices. Compound sales growth averaged 9.3% annually over the past five years.

How has the company generated such high returns, and to what extent are these returns sustainable? The answer lies in understanding the supply side of the industry—specifically, the production process, market structure, competitive dynamics, and pricing power.

Keep reading with a 7-day free trial

Subscribe to Envision Malaysia 10X stock investment to keep reading this post and get 7 days of free access to the full post archives.